Market Commentary for the Third Quarter 2018

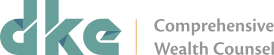

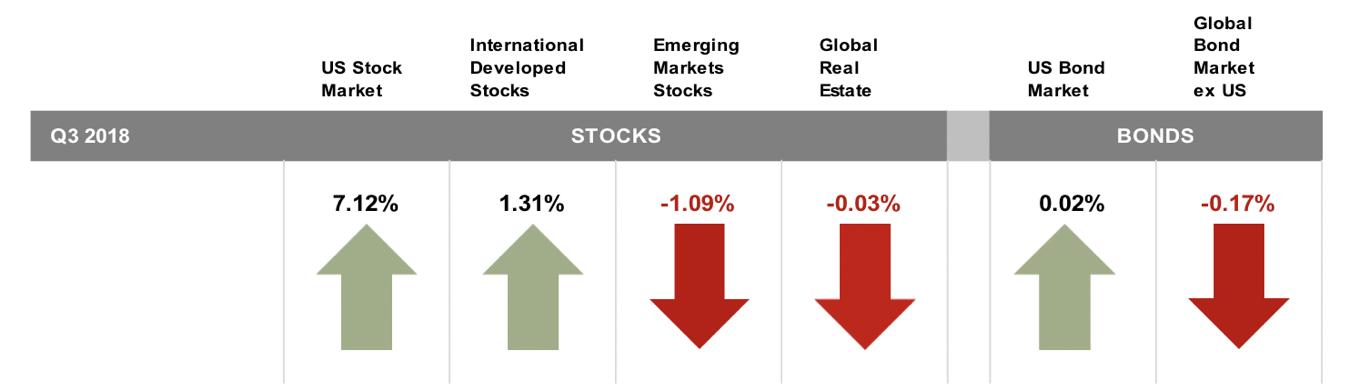

Tariffs, NAFTA, and Brexit all clouded the view for global trade going forward and the impacts that might have on economies and companies. The US equity market posted a positive return, outperforming both non-US developed and emerging markets. Value stocks underperformed growth in the US across large and small cap stocks. Small cap stocks underperformed large caps in the US.

In US dollar terms, developed markets outside the US underperformed the US but outperformed emerging markets during the quarter.

Large cap value stocks underperformed large cap growth stocks in non-US developed markets; however, small cap value outperformed small cap growth. Small caps underperformed large caps in non-US developed markets.

Interest rates increased in the US during the third quarter. The yield on the 5-year Treasury note rose 21 basis points (bps), ending at 2.94%. The yield on the 10-year Treasury note increased 20 bps to 3.05%. The 30-year Treasury bond yield rose 21 bps to 3.19%. On the short end of the yield curve, the 1-month Treasury bill yield increased 35 bps to 2.12%, while the 1-year Treasury bill yield rose 26 bps to 2.59%. The 2-year Treasury note yield finished at 2.81% after an increase of 29 bps.

Inflation continued to rise, hitting the highest levels since 2012, and jobless claims hit their lowest levels since 1969. There were about as many unemployed people in the U.S. as there were jobs going unfilled.

In terms of total return, short-term corporate bonds gained 0.71%, while intermediate-term corporate bonds returned 0.80%. Short-term municipal bonds declined 0.11%, while intermediate-term municipal bonds dipped 0.06%. Revenue bonds (‒0.16%) performed in line with general obligation bonds (‒0.14%).

Diversification among and within asset classes still provides the opportunity for expected benefits by assuring that top-performing asset classes and companies will be represented in the portfolio and by reducing overall portfolio volatility.

October 2018 by the DKE Investment Team